Worldwide Digital Camera Market Hits a Three-Year High

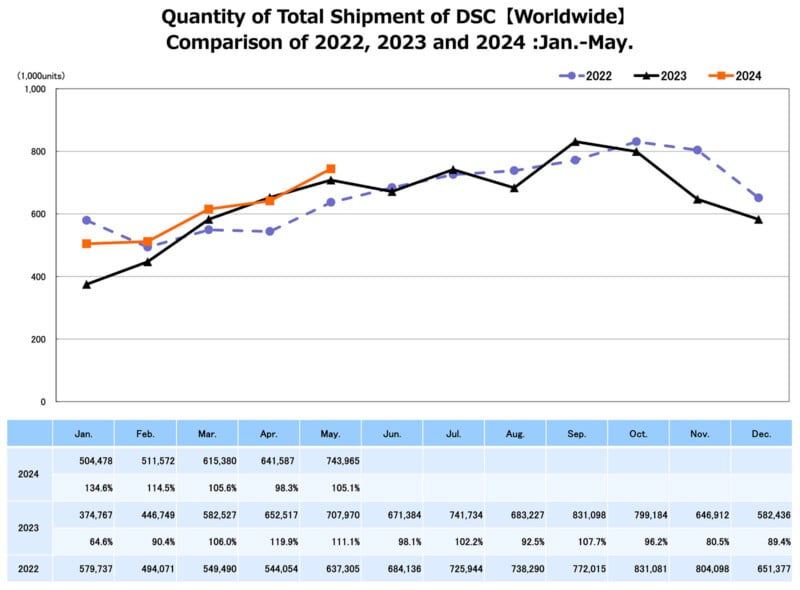

The latest CIPA results show that May was an excellent and interesting month for the photography industry. For the January through May period, camera sales hit their highest levels in the past three years.

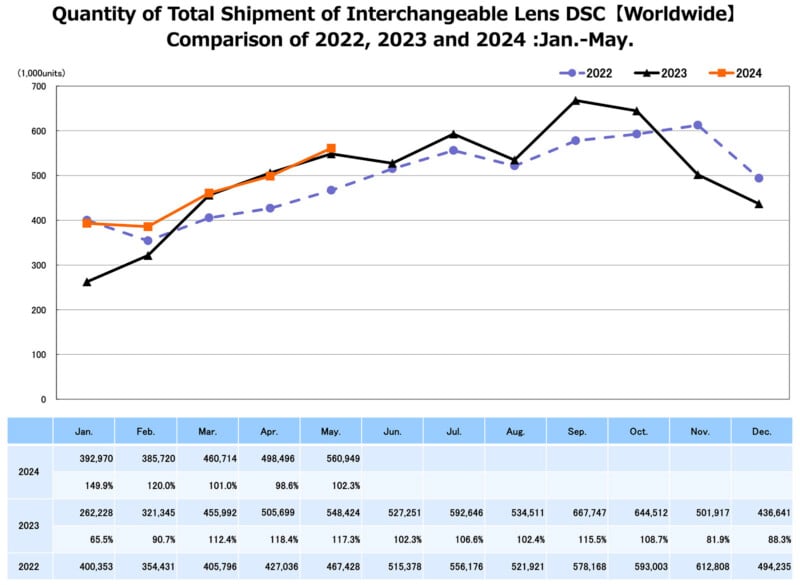

The good news goes beyond May, the most recent month captured by CIPA data. As noted by DPReview, total interchangeable lens camera shipments from January through May of this year increased by nearly 10% compared to last year and just under 12% compared to 2022.

CIPA’s data doesn’t include a comprehensive breakdown of cameras shipped and sold by specific manufacturers. Still, the data delves into digital camera categories, including those with built-in lenses, interchangeable lens cameras, and DSLR versus mirrorless models. It also looks at shipments to different regions, including China, Japan, Asia (except for Japan and China), Europe, and the Americas, plus a catch-all “other areas” column.

There is quite a bit of fascinating information inside the data table, including how vital the Chinese market is for digital camera makers. From January through May inclusive, 3.04 million cameras were shipped worldwide, and 706,352 went to China — a shade over 23%. Looking at the same period in 2022, January-May, total digital camera shipments to China were 451,565 units, representing 16% of the market then.

It’s also interesting to consider the relative popularity of mirrorless interchangeable lens cameras across different markets. Looking at ILCs, the ratio of mirrorless to SLR in China is about 25:1. In Japan, that ratio is a much lower 11.7:1 so far in 2024. In Europe and the Americas, the ratio of mirrorless to SLR is roughly 2.7:1.

Looking at DSLR versus mirrorless popularity in general over the same period in 2022, 2023, and 2024, the global consumer preference for mirrorless over DSLR has shifted from 1.7:1 to 3.6:1 to 5.1:1 in the current period. DSLR is still alive — tens of thousands are sold every month — but photographers aren’t purchasing them at anywhere near the same rate anymore.

It’s also not obvious precisely which DSLR models people are buying. PetaPixel sources suggest that Canon only makes Rebel models these days, and Nikon hasn’t touched its DSLR system in years. Ricoh Pentax is still committed to DSLRs, though, and launched the popular K-3 III Monochrome last year.

![Line chart showing "Quantity of Total Shipment of Built-in Lens DSC [Worldwide]" comparison for January to May in 2022, 2023, and 2024. The X-axis represents months, and the Y-axis shows shipments in thousands. Data tables for monthly values are below the chart.](jpg/cipa-built-in-lens-sales-2024-jan-may.png-800x586.jpg)

Considering the camera industry is currently experiencing a surge of demand for all-in-one compact cameras, like the GR III, Fujifilm X100VI, and Leica D-Lux 8, it is appealing to attribute the uptick in camera shipments to that market segment. Of the 3,041,002 cameras shipped from January through the end of May around the world, 23.5% of them are for cameras with built-in lenses. This is a slight decrease compared to 2023 and 2022 over the same period. However, if customers could actually purchase some of these compact cameras, many of which are regularly sold out, the numbers would be significantly different.

Beyond individual unit numbers, CIPA also publishes data on the value of cameras produced. All digital cameras shipped in 2024 are worth $289,364,176, nearly $40 million higher than the total worldwide digital camera shipment value last year over the same period.

It’s good to see industry numbers supporting what individual camera companies have been saying — things are looking up.

Image credits: CIPA. The CIPA trade group includes all major players in the photo industry, including Canon, Fujifilm, Nikon, OM System, Sony, Pansonic, Sigma, Tamron, and more. The complete member list is available on CIPA’s website.